TERM INSURANCE

Buying the Right Term Insurance doesn't have to be Difficult!

You just need to answer 3 Simple Questions -

💵How much Cover should you have?

🗓️What's the Appropriate Term Length?

👨🦽What Riders should you take?

How much Cover should you have?

Choose a Sufficient Coverage Amount to cover your -

🔸Financial Goals

🔸Any Outstanding Debts

🔸Your Family’s day-to-day Expenses, and

🔸Provide Financial Support to your Dependents

Here is a step-by-step guide to Choosing the Right Cover for You –

- Calculate your day-to-day Household Expenses

- Add to that all you Liabilities and Goals, such as a home loan or children’s education.

- Include the additional expenses for Financially Dependent Parents

The total of these expenses and goals is the amount of money that your Family will need

- Deduct the Present Value of your Investments and Life Cover you already have.

- Exclude assets such as your home and car, as your family members are likely to continue using them.

Deduct your Investments and Insurance Cover from your Expenses and Goals.

This is how much Cover you need to purchase!!

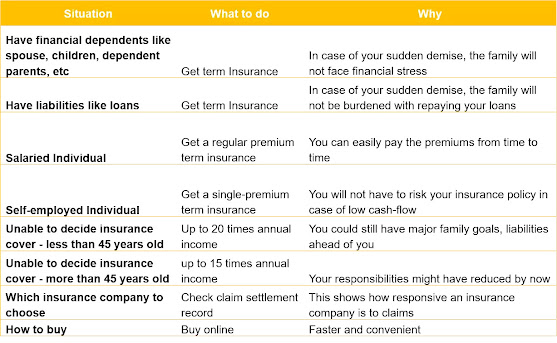

Seems complicated? Don’t worry, use this simple Rule of Thumb to calculate your Cover amount –

🔸Your Insurance Cover = Any existing loan + 20 times annual expenses - Any existing cover

What’s the Appropriate Term Length?

Insurance companies nowadays provide cover for up to 100 years. This is just a TRAP!!

Most people will think that a Longer Term Length will mean Assured Return. However, this is where they go Wrong.

The longer the Term of your →The Higher your Premium → Lower the Returns on Premium.

Also, by the time you are 65-70, your children start earning and become Financially Independent. You are free of any Liabilities.

That’s why a term length of 65-70 years is OPTIMUM!

What Riders to opt for?

Riders offer Additional Benefits over your Base Insurance policy at a Nominal Premium. Some of the most popular ones are –

- Accidental Death and Disability Benefit

- Critical Illness

- Waiver of Premium

- Return of Premium

- Family Income Benefit

However, Choosing the appropriate Riders for your Term Plan depends on a lot of factors.

Consider the following factors before adding riders to your term plan –

1. Your Base Plan

2. Your Goals

3. Costs and overall value of the rider

4. How likely are you to use it

Comments

Post a Comment